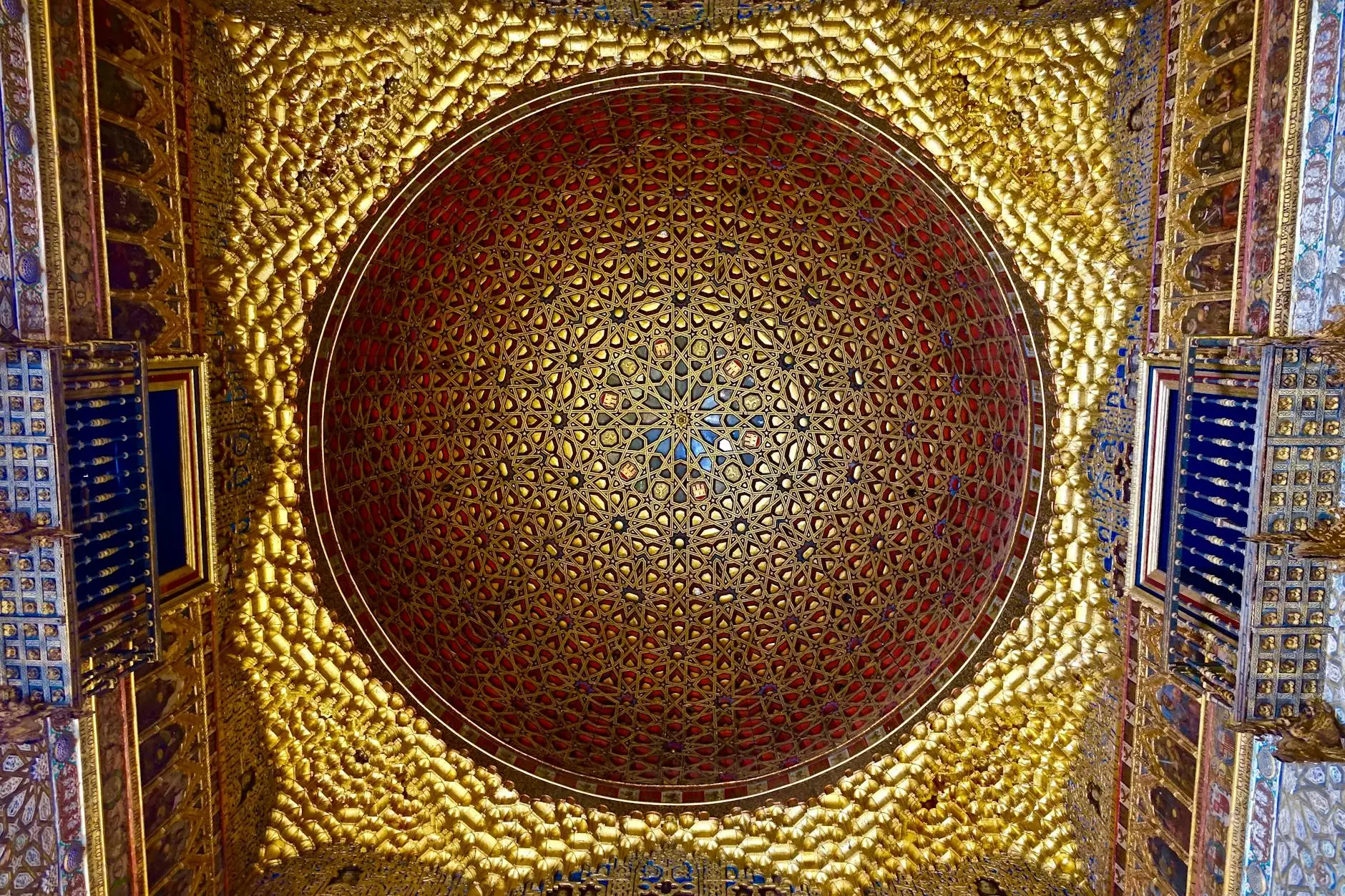

Investing in Precious Metals: Your Gateway to Wealth

Precious metals have long been recognized not just as materials of beauty but as powerful financial assets. In times of economic uncertainty, inflation, and fluctuating currencies, investors turn to gold, silver, platinum, and palladium as safe-haven assets. This article will explore the different categories of precious metals available for investment, their unique benefits, and why they should be a part of your financial portfolio.

The Allure of Precious Metals

Investing in precious metals is not merely a trend; it’s a strategic approach to wealth preservation. Here’s why they are considered invaluable:

- Intrinsic Value: Unlike paper currency, precious metals have inherent value. Their worth is recognized globally.

- Hedge Against Inflation: In times of rising prices, precious metals often maintain their purchasing power.

- Portfolio Diversification: Incorporating metals can reduce risks associated with traditional stock and bond markets.

- High Demand: These metals are not only seen as investments but also play vital roles in industry, technology, and jewelry.

Categories of Precious Metals

Gold Bullion

Gold has been a symbol of wealth for centuries, often viewed as the ultimate form of currency. Investors can acquire gold in various forms, including:gold bars and coins. This category is particularly popular due to the following reasons:

- Stability: Gold prices tend to be stable in the long term, making it a reliable investment.

- Liquidity: Gold can easily be converted into cash, a feature especially important during emergencies.

- Global Acceptance: No matter where you go, people recognize and accept gold.

Silver Bullion

Silver is often referred to as the "people's metal" and offers a unique set of advantages:

- Affordability: Often less expensive than gold, silver allows new investors to enter the precious metals market.

- Industrial Demand: Silver has numerous industrial applications, which can drive its demand and price appreciation.

- Historical Performance: Over the long term, silver has shown strong price performance compared to other assets.

Platinum Bullion

Platinum is rarer than gold and silver, which gives it a unique appeal among investors. Some benefits include:

- Rarity: With platinum being less abundant, there's potential for value increase.

- Industrial Uses: Mostly used in the automotive industry for catalytic converters, its demand is driven by performance in manufacturing sectors.

- Global Investment: As with gold, platinum also enjoys international recognition as a trusted store of value.

Palladium Bullion

Palladium is another precious metal gaining traction among investors, particularly for its unique features:

- Higher Price Volatility: Palladium prices can be more volatile, which means higher risk but also higher potential rewards.

- Technological Advancement: Its use in technology, especially in electronics and clean energy, is on the rise.

- Strong Demand: Increased use in green technologies, especially in catalytic converters for vehicles, has bolstered its market.

Why Invest in Bullion?

Investing in bullion serves multiple purposes in wealth management:

- Physical Asset Ownership: Unlike stocks, you own something tangible.

- Secure Storage: Precious metals can be stored in a variety of ways, including personal safes, banks, or vaults.

- Minimal Counterparty Risk: When owning bullion, you're less susceptible to the risks associated with financial intermediaries.

Where to Buy Precious Metals?

When it comes to purchasing bullion, it’s important to choose a reputable dealer. Don’s Bullion provides a wide range of options, making it easier for customers to find the right investments. Whether you are looking for gold bars, silver coins, or platinum ingots, Don’s Bullion stands as a reliable source for quality and trust.

Understanding Market Dynamics

The precious metals market is influenced by various factors:

- Global Economic Conditions: Economic stability directly affects demand.

- Central Bank Policies: Decisions made by central banks regarding reserves can shift market dynamics.

- Industrial Demand: Fluctuations in manufacturing and industrial usage can influence prices, particularly for silver and platinum.

Investing Strategies for Precious Metals

Investing in precious metals should be approached strategically. Here are some methods:

- Buy and Hold: Purchase bullion and hold for long-term appreciation.

- Dollar-Cost Averaging: Regularly invest a fixed amount, which helps mitigate volatility.

- Trade on Market Fluctuations: If experienced, consider trading based on market trends and timing.

Conclusion: Secure Your Financial Future

In conclusion, investing in gold, silver, platinum, and palladium bullion is not only wise but essential for building and securing your financial future. Whether you're a novice investor looking to make your first investment or a veteran trader seeking to diversify your portfolio, precious metals offer unparalleled benefits. Start your journey today with trusted dealers like Don’s Bullion to ensure you’re investing in quality assets that withstand the tests of time.

For more information on the latest offerings and insights in precious metals, don't hesitate to visit Don’s Bullion today.

https://donsbullion.com/product-category/gold/gold-bar/